Results Meeting of Diagnostyka S.A. for the Q3 2025

14 November 2025

We care for the health

of tens of millions of Poles.

14 November 2025

5 September 2025

2 September 2025

1 July 2025

Diagnostyka Group operates in the medical diagnostics sector in Poland. The Group began its operations in 1998, building a market-leading position in terms of the number of laboratories and blood collection points, the total number of tests performed, the number of employed specialists, and the size of its own courier network. The Group’s business model is based on providing comprehensive medical diagnostic services.

The Group operates on a large and rapidly growing Polish diagnostics market, whose expansion is driven by numerous favorable structural trends. The most important of these include rising wages and increase in the wealth of society, a growing average life expectancy and the aging of the population, increasing health awareness, the rising importance of preventive care, a growing number of chronic diseases, as well as significant growth potential related to the opportunity to bring diagnostic service prices closer to the levels observed in Western European countries.

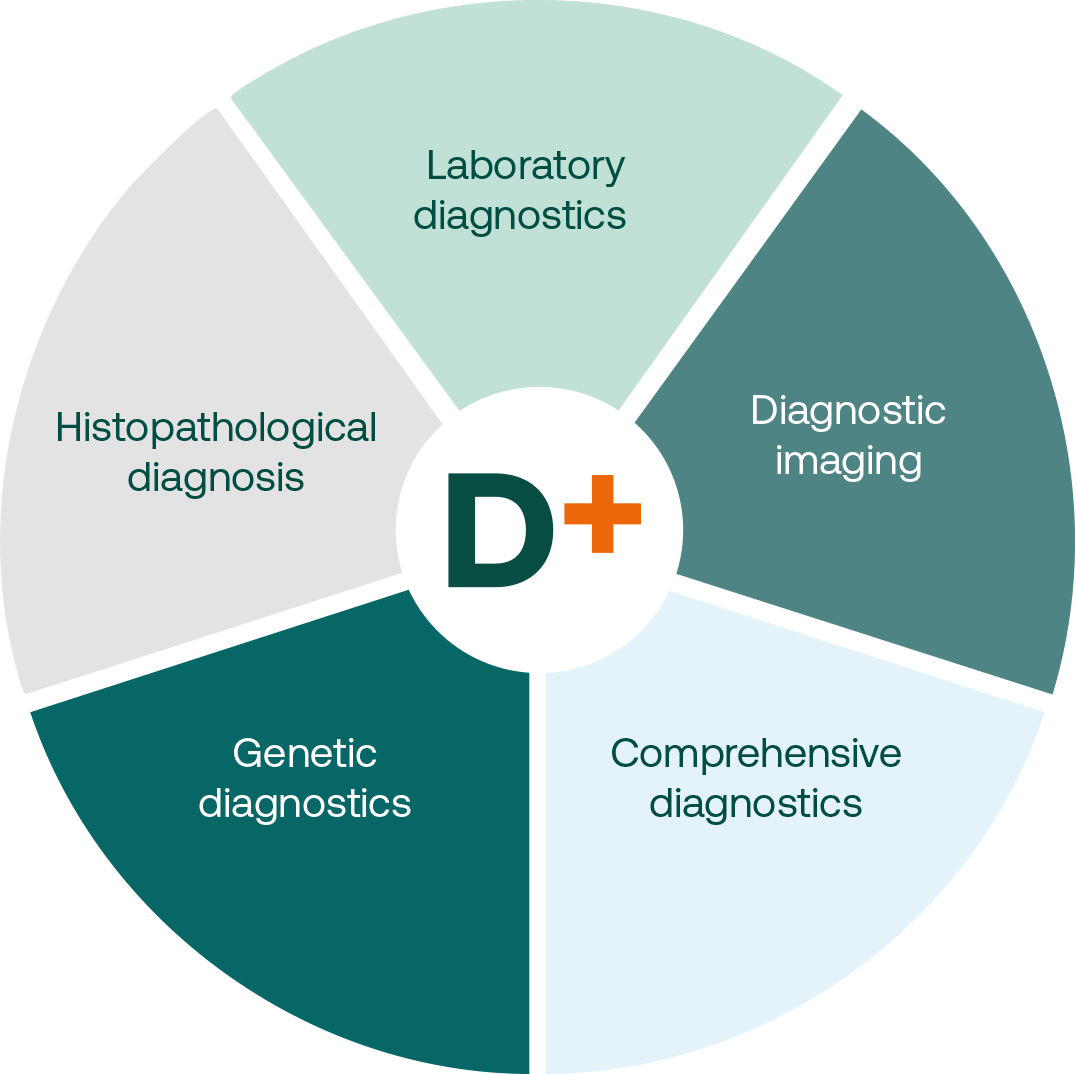

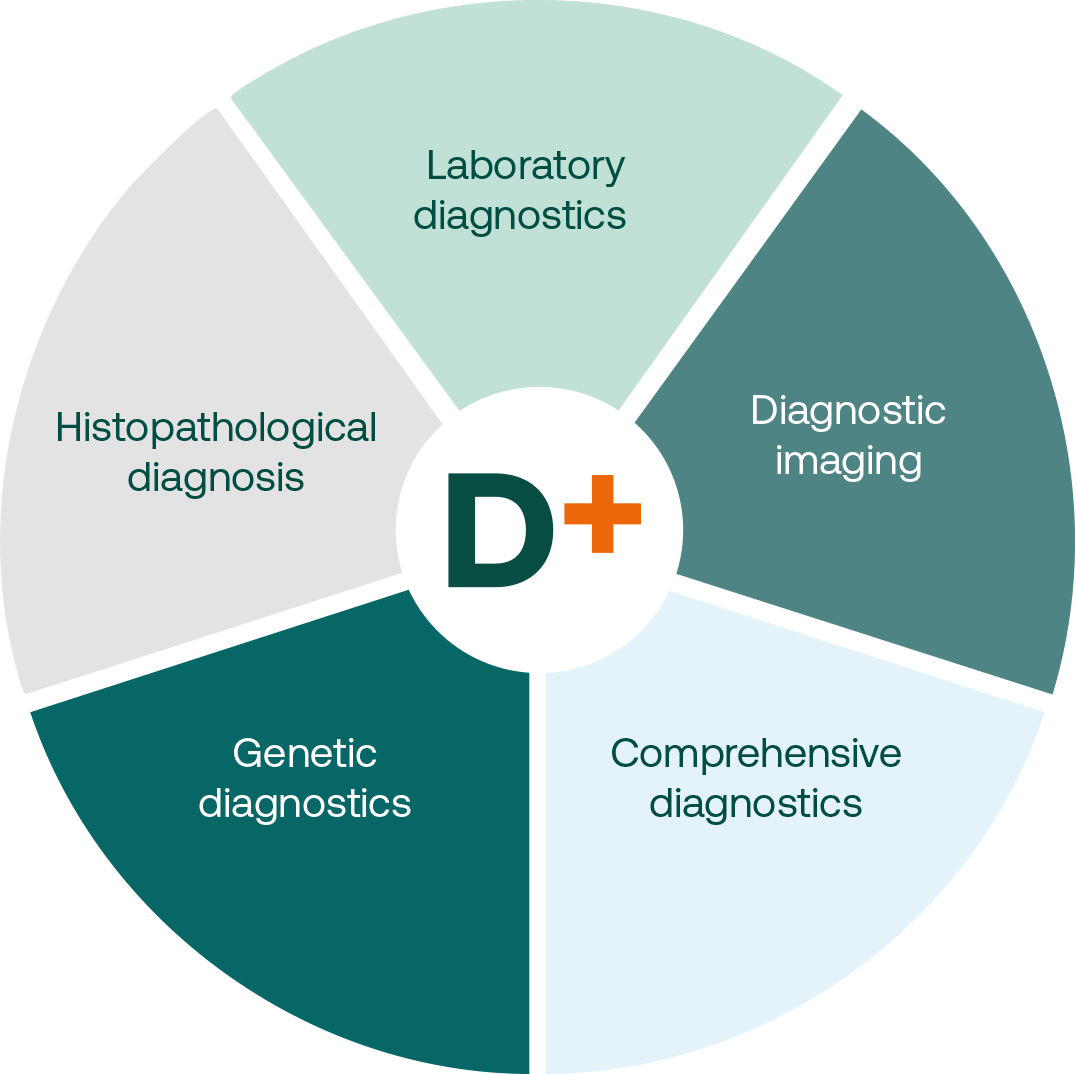

Diagnostyka performs medical diagnostic tests in the following areas: laboratory diagnostics, genetic diagnostics, histopathological diagnostics, medical imaging diagnostics, comprehensive diagnostics (Longevity+)

The Group’s offer is addressed to the following customer groups:

-individual clients (B2C) – individuals who order and pay for tests at collection points, facilities, or online

-institutional clients (B2B) – small, medium, and large medical entities (both public and private) and other entities, including those from related industries.

The Group is expanding through a synergy of organic growth (including volume and pricing), selective acquisitions and disciplined financial management.

The Group’s priorities are to increase its market share in diagnostic imaging, expand and optimise its laboratory network and explore new sales channels, including Longevity+, an innovative subscription model offering a wide range of preventive medicine services.

The Group is expanding through a synergy of organic growth (including volume and pricing), selective acquisitions and disciplined financial management.

The Group’s priorities are to increase its market share in diagnostic imaging, expand and optimise its laboratory network and explore new sales channels, including Longevity+, an innovative subscription model offering a wide range of preventive medicine services.

Diagnostyka Group strives for profitable growth, guided by strategic priorities:

President of the Management Board

Vice-President of the Management Board

Vice-President of the Management Board

Vice-President of the Management Board

Vice-President of the Management Board

Chairman of the Supervisory Board

Member of the Supervisory Board

Member of the Supervisory Board

Member of the Supervisory Board

Member of the Supervisory Board

Member of the Supervisory Board

Member of the Supervisory Board

Member of the Supervisory Board

Sign up to our newsletter to have the information on investor relations delivered to your inbox.

The email address to which the notification referred to in Article 19 of MAR and Article 69 of the Public Offering Act should be sent:

insider@diag.plLink to an IPO page

Go